The challenge

Bank platforms and processes in use today severely limit the ability to offer rich customer experiences and personalised product offerings. Technology platforms are outdated and siloed, inhibiting the ability to change and innovate.

In Soluix’s target market, Indonesia, this is compounded by the growing need for Sharia compliant financial products. Islamic banking products are unique when compared to conventional products and require expertise, experiences, and platforms that are built to handle them.

The solution

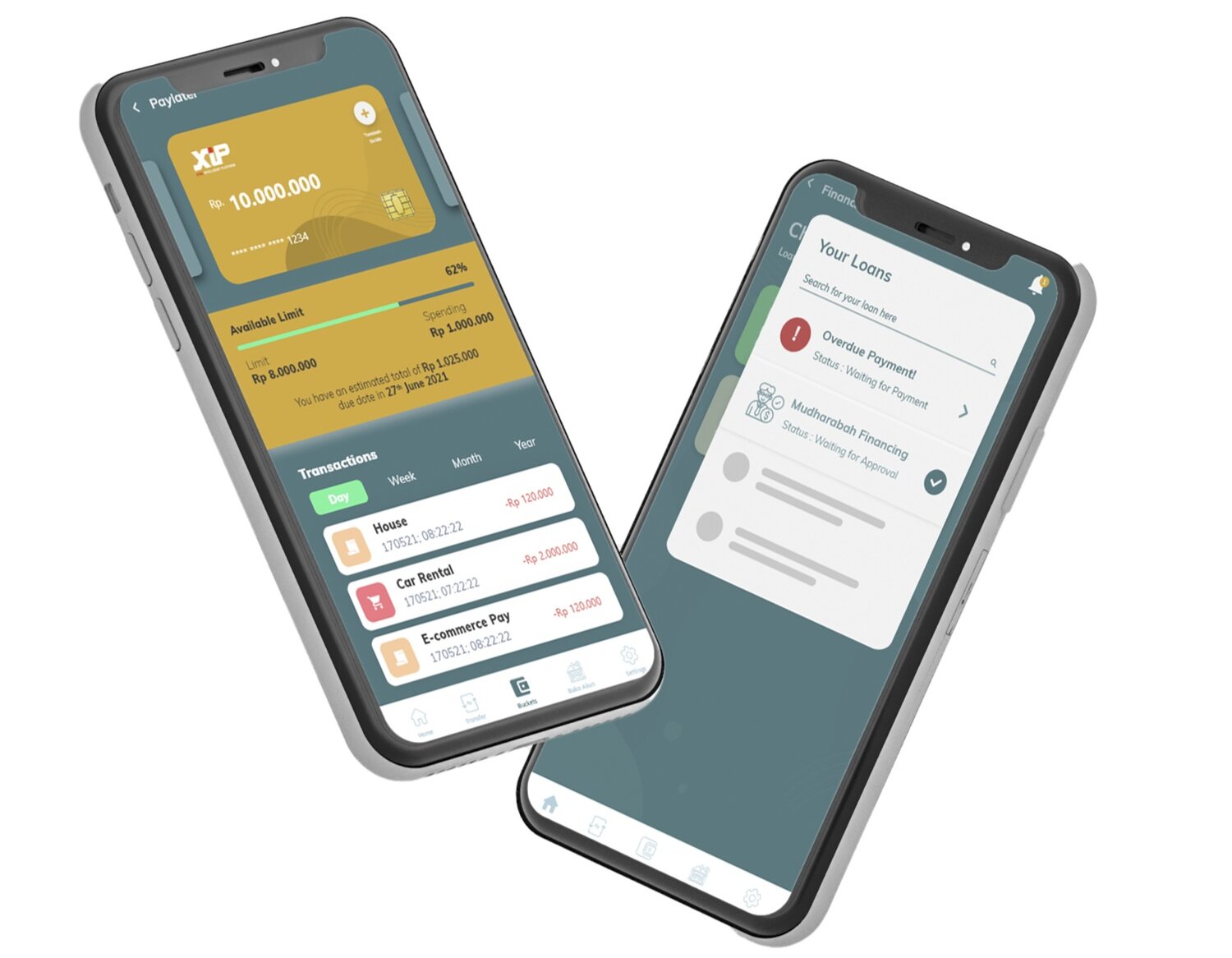

Soluix’s Xtra Intelligent Platform (XIP), leveraging Vault Core, brings all the benefits of cloud native technology to banks, with an emphasis on those focused on Islamic banking. XIP provides a rich front-end customer experience, tailored to the Indonesian market, as well as API management and orchestration layers to allow banks to easily connect multiple systems, whether internal or external, to design and build a full bank ecosystem. For the customer experience, XIP incorporates Sharia compliant features into its product design so that banks can meet regulatory requirements more effectively.

Enhanced customer experience

- Reduce digital onboarding to a matter of minutes with XIP's automated process enabled through optical character recognition of IDs, liveness detection, and video KYC.

- Allow customers to track their spending, savings, and loans all in one place with a seamless, personalised experience in XIP’s front-end application

Improved operational efficiency

- Easily integrate with best of breed providers with XIP's API-driven architecture built to leverage the full benefits of open banking

- Meet local regulatory needs such as Sharia law compliance, reporting, and payments with XIP's country specific components

XIP is designed and built to be open source, API first, and microservices driven. XIP consists of three platform layers - (1) Channel, (2) API Management, and (3) Services Middleware - that sit on top of Vault Core and include the following functionality:

- Customer Onboarding: automated workflow to help fulfil the digital onboarding process, incl. eKYC (OCR of IDs, Face Liveness & Face Compare) and vKYC (in the form of Video Call)

- Customer Servicing: via mobile, tablet, or desktop, support all digital banking transactions and payments to related ecosystems

- API Management & Middleware: enable open banking and ability to interact and integrate with other ecosystems & external systems

- Regulatory & Compliance: components to address local country requirements, ie. Sharia law, regulatory reporting, payments & clearing, etc

Leveraging Vault Core’s Universal Product Engine and Soluix's experience working with Islamic banking institutions, Soluix provides a range of Sharia compliant products within XIP. One example is a buy now, pay later loan, which incorporates the Islamic banking concept, Ijarah. The product enables customers to request an unlimited number of short-term loans within their credit line in one account, with each loan having its own term and repayment schedule.